Introduction

The electric vehicle (EV) revolution is reshaping the global auto industry, and North America is at the center of this transformation. While the United States and Canada share a border, cultural ties, and strong trade relations, their approaches to EV adoption are different. Both countries are making progress, but their growth rates, government support, infrastructure, and consumer interest show clear contrasts.

This article takes a deep dive into how EV growth in the USA compares with Canada in 2025. We’ll explore sales trends, charging networks, incentives, automaker strategies, and future outlooks. Whether you’re an EV buyer, policymaker, or industry watcher, this side-by-side comparison will help you understand where each country stands in the race toward electrification.

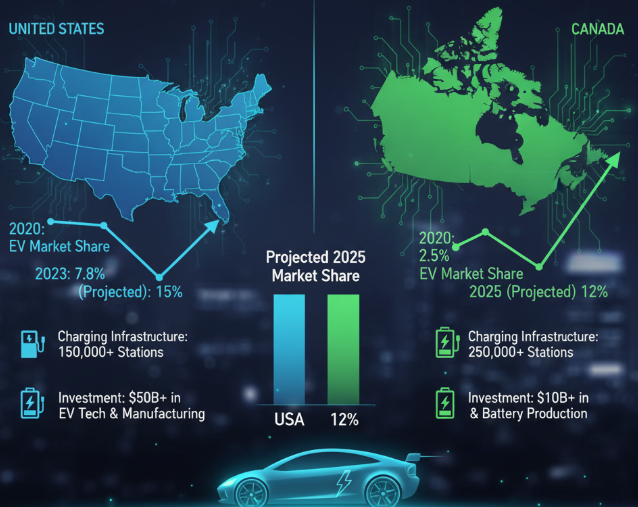

EV Market Growth in Numbers

USA EV Market Snapshot (2025)

- EV market share (2024): 8.2% of all new car sales

- Estimated EV market share (2025): 10–12%

- Number of EVs on the road: 3.5+ million

- Top-selling EV brands: Tesla, Ford, GM, Hyundai, Kia

Canada EV Market Snapshot (2025)

- EV market share (2024): 12.1% of all new car sales

- Estimated EV market share (2025): 14–16%

- Number of EVs on the road: 600,000+

- Top-selling EV brands: Tesla, Hyundai, Kia, Ford, Volkswagen

📊 Quick Comparison Table: USA vs Canada EV Growth (2025)

| Factor | USA | Canada |

|---|---|---|

| EV Market Share (2025 est.) | 10–12% | 14–16% |

| EVs on Road | 3.5M+ | 600K+ |

| Top EV Model | Tesla Model Y | Tesla Model Y |

| Federal Incentives | Up to $7,500 tax credit | Up to $5,000 purchase rebate |

| Charging Stations (2025) | 160,000+ public chargers | 30,000+ public chargers |

| 2035 Sales Ban on Gas Cars? | Not nationwide (state-based) | Yes, nationwide commitment |

Government Policies Driving EV Growth

United States

The U.S. government is pushing EV adoption primarily through:

- Federal Tax Credits: Up to $7,500 for qualifying EVs (subject to income and vehicle price limits).

- State Incentives: California, New York, Colorado, and others add extra rebates.

- Infrastructure Bill (NEVI program): $7.5 billion allocated to building 500,000 EV chargers nationwide.

- State-Level Bans: California and several states plan to ban sales of new gas cars by 2035.

Canada

Canada’s EV push is more nationwide and aggressive:

- Federal Incentive: Up to $5,000 rebate for EV purchases.

- Provincial Incentives: Quebec (up to $7,000) and British Columbia (up to $4,000) make EVs even more affordable.

- Zero-Emission Vehicle (ZEV) Mandate: Requires 100% of new car sales to be electric by 2035 nationwide.

- Charging Infrastructure Program: Federal government investing heavily in coast-to-coast networks.

💡 Key Difference:

The USA relies on state-level leadership, while Canada enforces a nationwide strategy.

Charging Infrastructure: Availability and Challenges

USA Charging Network

- Over 160,000 public chargers (2025)

- Tesla Supercharger network opening to other brands

- Federal goal: 500,000 chargers by 2030

- Challenge: Uneven distribution, with rural areas still underserved

Canada Charging Network

- Over 30,000 public chargers (2025)

- High concentration in urban centers (Toronto, Montreal, Vancouver)

- Long-distance highway routes already covered with DC fast chargers

- Challenge: Canada’s vast geography and cold climate affect performance

📊 Chart: Growth of Public Charging Stations (2018–2025)

(Imagine a line graph where both USA and Canada show steady upward growth. The USA line is higher due to scale, but Canada’s slope is steeper due to faster adoption per capita.)

Automaker Strategies: USA vs Canada

USA Automakers Leading the Charge

- Tesla: Still dominates, especially with Model Y and Cybertruck.

- Ford: Mustang Mach-E, F-150 Lightning leading the American EV pickup market.

- GM: Chevrolet Blazer EV, Silverado EV, Cadillac Lyriq targeting mass and luxury buyers.

- Rivian & Lucid: EV startups gaining traction.

Canadian Market Trends

- Tesla leads sales, but Korean brands Hyundai and Kia are surging.

- Volkswagen and Toyota hybrids-to-EV transitions attract Canadian buyers.

- Pickup EVs (Ford Lightning, Silverado EV) appealing in provinces like Alberta.

- Canada imports most EVs but aims to boost domestic EV battery manufacturing.

Consumer Behavior: Who’s Buying EVs?

United States

- Buyers are spread across urban and suburban areas.

- Top EV states: California, Florida, Texas, New York.

- Many buyers motivated by tech features, fuel savings, and climate concerns.

- Pickup trucks are critical: EV adoption rises in states where electric pickups are available.

Canada

- Higher per capita EV adoption compared to the USA.

- Top EV provinces: Quebec, British Columbia, Ontario.

- Government rebates strongly influence buying decisions.

- Harsh winters affect range, but buyers are adapting with home chargers and pre-conditioning.

Key Challenges Facing Both Countries

USA Challenges

- Patchy charging network in rural areas

- EV affordability without incentives

- Political divisions slowing nationwide mandates

- Dependence on Chinese supply chains for batteries

Canada Challenges

- Limited domestic EV supply (reliant on imports)

- Cold-weather impact on battery range

- Sparse infrastructure in northern provinces

- Smaller market makes automakers prioritize U.S. launches first

Environmental Impact and Energy Mix

- USA: Still heavily dependent on natural gas and coal, though renewables are growing. EV benefits vary by state—greener in California, less so in coal-heavy states.

- Canada: One of the cleanest electricity grids in the world (over 80% from hydro, nuclear, wind, and solar). EVs in Canada offer greater emissions reduction per vehicle compared to the U.S.

Future Outlook: Where EV Growth is Heading

USA Predictions (2030)

- EV market share expected: 30–40% of new car sales

- Nationwide charging network more robust

- Pickup trucks and SUVs will dominate EV growth

- Automakers increasing domestic EV and battery production

Canada Predictions (2030)

- EV market share expected: 40–50% of new car sales

- Strong nationwide ZEV mandate ensures steady growth

- Charging stations per capita higher than the U.S.

- Canada emerging as a global EV battery supplier due to mineral resources (nickel, lithium, cobalt).

📊 Table: USA vs Canada EV Outlook by 2030

| Category | USA (2030 est.) | Canada (2030 est.) |

|---|---|---|

| EV Share of New Sales | 30–40% | 40–50% |

| Public Chargers | 500,000+ | 100,000+ |

| Gas Car Ban Status | State-level only | Nationwide by 2035 |

| Battery Manufacturing | Expanding rapidly | Global supplier in progress |

5 Big Takeaways: USA vs Canada EV Growth

- Canada has higher EV adoption per capita than the USA.

- The USA leads in total volume, thanks to its massive auto market.

- Canada’s nationwide ZEV mandate ensures faster long-term growth.

- The USA depends on state policies, making progress uneven across the country.

- Both nations are critical players in North America’s EV future: the U.S. as the volume leader, and Canada as the clean energy and battery powerhouse.

Conclusion

The comparison of EV growth in the USA vs Canada shows two different but complementary approaches. The United States focuses on scale, innovation, and automaker dominance, but struggles with policy uniformity. Canada, though smaller, is achieving faster per-capita adoption through strong nationwide mandates and clean energy advantages.

By 2030, both countries will play essential roles in shaping the future of electric mobility: the U.S. as a massive EV market and Canada as a global leader in sustainable adoption and EV battery supply chains.

The EV race in North America isn’t about one country outpacing the other—it’s about how both together can lead the world toward a cleaner, electrified future.

Leave a Reply