Introduction: Can You Really Get an EV Loan with Bad Credit?

Electric vehicles (EVs) are no longer a luxury item. With rising fuel prices, government rebates, and the growing availability of charging stations, many people are making the switch to cleaner transportation. But there’s a challenge: what if you have a low credit score?

Banks and lenders often prefer borrowers with strong credit histories. However, having bad or fair credit does not automatically shut the door on getting approved for an EV car loan. With the right approach, preparation, and strategies, you can still finance your dream EV—even if your credit isn’t perfect.

This guide will walk you through practical steps, insider tips, and proven methods to improve your chances of qualifying for an EV loan with a low credit score.

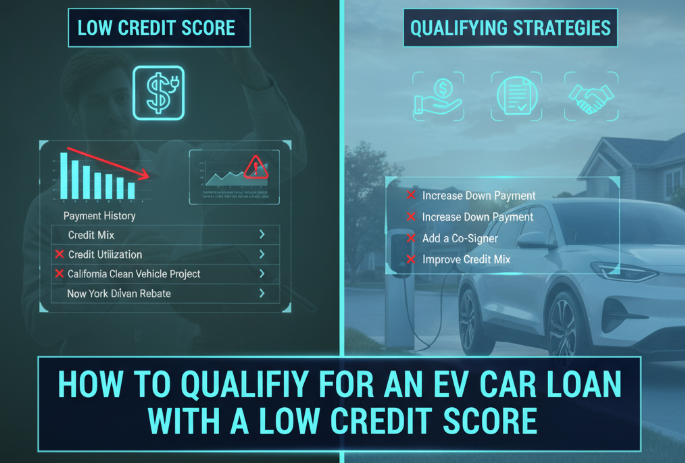

Why Credit Score Matters for EV Car Loans

Your credit score is one of the first things lenders check before offering financing. It’s basically a number that shows how trustworthy you are with money.

Here’s how lenders typically see credit scores:

| Credit Score Range | Credit Status | Loan Approval Chances | Interest Rate Expectation |

|---|---|---|---|

| 750 – 850 | Excellent | Very High | Lowest rates available |

| 700 – 749 | Good | High | Competitive rates |

| 650 – 699 | Fair | Moderate | Slightly higher rates |

| 600 – 649 | Poor | Low | Higher interest |

| Below 600 | Very Poor | Very Low | Very high interest, limited lenders |

If your score is below 650, lenders see you as “risky.” That doesn’t mean you can’t get a loan—it just means you’ll need to be more strategic.

Step 1: Check Your Credit Report Before Applying

Before applying for an EV car loan, you need to know exactly where you stand. Many applicants are rejected not because of their score alone, but because of mistakes in their credit reports.

How to Check:

- Get a free credit report from major bureaus like Equifax, Experian, or TransUnion.

- Look for errors—like old debts marked as unpaid or accounts that don’t belong to you.

- Dispute inaccuracies immediately (this can sometimes increase your score within weeks).

Pro Tip: Even a 20–30 point increase in your credit score can move you into a better lending bracket, saving you thousands in interest over time.

Step 2: Consider Government and Special EV Loan Programs

One major advantage of buying an EV is the extra support from government programs. Some lenders partnered with clean energy initiatives are more flexible with credit scores.

Programs to Explore:

- Federal Tax Credit (USA) – Up to $7,500 for qualifying EVs.

- State EV Incentives – Rebates, reduced registration fees, or grants.

- Green Auto Loan Programs – Certain credit unions and community banks offer lower rates for EVs, even if your credit isn’t ideal.

👉 These programs don’t directly improve your credit score, but they can reduce the loan amount you need, making approval easier.

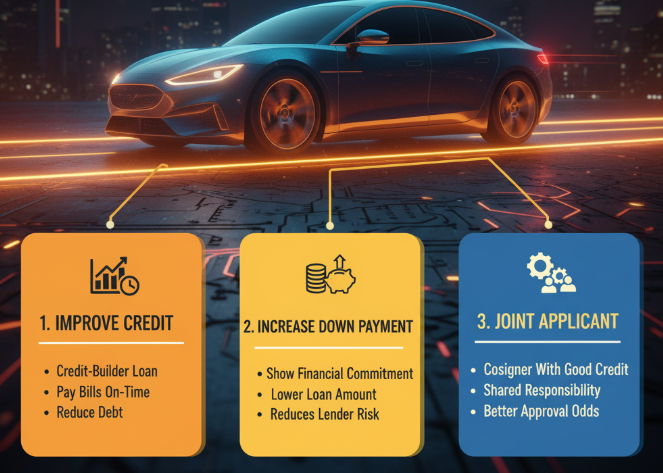

Step 3: Save for a Bigger Down Payment

One of the best ways to convince a lender to approve your EV loan with bad credit is to put more money upfront.

Why it helps:

- Reduces the loan amount (less risk for the lender).

- Shows financial responsibility.

- May qualify you for lower interest rates.

For example:

- EV Price: $35,000

- Down Payment: $10,000

- Loan Needed: $25,000

A lender is more likely to approve $25,000 than the full $35,000 if your credit history is shaky.

Step 4: Explore Credit Unions and Community Banks

Large national banks often have strict lending rules. But credit unions and local banks are known for being more flexible.

Why Credit Unions May Say Yes When Banks Say No:

- Member-focused (not just profit-driven).

- Offer green auto loans specifically for EVs.

- More likely to consider your income, job stability, and payment history instead of just your credit score.

👉 If you have a stable job and steady income, a credit union might approve your EV loan even with a low credit score.

Step 5: Show Proof of Steady Income

When credit is weak, income stability becomes more important. Lenders want to know you can make monthly payments consistently.

Documents to Prepare:

- Recent pay stubs (last 2–3 months).

- Bank statements.

- Employment verification letter.

- If self-employed: tax returns or business income records.

Tip: If you’ve recently switched jobs but within the same industry, explain this to the lender. It shows long-term stability.

Step 6: Improve Debt-to-Income Ratio (DTI)

Even if your credit score is low, a strong DTI ratio can save your application.

What’s DTI?

It’s the percentage of your monthly income that goes toward paying debts.

Formula:

DTI = (Monthly Debt Payments ÷ Monthly Gross Income) × 100

Example:

- Monthly Income: $4,000

- Monthly Debt Payments: $800

- DTI = 20% (Good)

Lenders prefer DTI below 36%. If your DTI is high, pay off smaller debts before applying for an EV loan.

Step 7: Consider a Co-Signer

If your credit score is very low, having a trusted co-signer can dramatically improve approval chances.

Benefits of a Co-Signer:

- Lender sees less risk.

- May qualify you for lower interest rates.

- Helps you build your credit if you make on-time payments.

⚠️ But remember: If you miss payments, it will hurt both your credit and your co-signer’s credit. Only ask someone you trust deeply.

Step 8: Shop Around for Lenders

Don’t settle for the first loan offer you receive. With a low credit score, terms can vary widely.

Where to Compare:

- Traditional Banks

- Online Auto Loan Lenders

- Credit Unions

- EV-Specific Green Loan Programs

| Lender Type | Pros | Cons |

|---|---|---|

| Big Banks | Wide availability | Strict credit requirements |

| Credit Unions | Flexible, lower rates | Must become a member |

| Online Lenders | Fast approval | Higher fees possible |

| EV Loan Programs | Designed for EVs | Limited availability |

Step 9: Be Realistic with Your EV Choice

Not all EVs are priced the same. If your credit score is low, aiming for a budget-friendly EV can make a big difference.

Examples of lower-cost EVs (2025 models):

- Nissan Leaf – Approx. $28,000

- Chevrolet Bolt – Approx. $30,000

- Hyundai Kona Electric – Approx. $32,000

A $28,000 loan is far easier to qualify for than a $60,000 Tesla Model Y when your credit isn’t great.

Step 10: Prepare to Pay Higher Interest (At First)

If you have a low credit score, your interest rate will likely be higher than average.

Example:

- Good Credit EV Loan Rate: 5%

- Bad Credit EV Loan Rate: 10–15%

But here’s the good news: If you make 12–18 months of on-time payments, you can refinance later at a much better rate once your credit improves.

Step 11: Avoid Predatory Lenders

Be careful—some lenders take advantage of borrowers with bad credit by offering sky-high interest rates and hidden fees.

Red Flags to Watch For:

- Interest rates above 20%.

- Loan terms longer than 7 years (you’ll pay way more in the long run).

- “No credit check” lenders (often very expensive).

Stick to reputable lenders, credit unions, or banks instead.

Step 12: Strengthen Your Application with Extra Factors

Sometimes, small details can make your loan application stronger:

- Stable Address History – Staying in one place shows stability.

- References – Personal or professional references may be requested.

- Savings Account Balance – Shows financial discipline.

Every positive factor helps balance out a low credit score.

Step 13: Use Pre-Approval to Your Advantage

Before walking into a dealership, try getting pre-approved for a loan.

Why Pre-Approval Helps:

- You know your budget before shopping.

- Dealers may take you more seriously.

- Helps avoid being pressured into expensive financing options.

Step 14: Lease Instead of Buying (If Necessary)

If getting a loan approval seems too difficult, consider leasing an EV instead.

Benefits of Leasing with Bad Credit:

- Lower upfront costs.

- Lower monthly payments.

- Option to buy at the end of lease.

However, leasing still requires decent credit, so it’s not guaranteed—but some dealerships may be more flexible.

Smart Tips to Boost Approval Odds Quickly

If you have a few weeks or months before applying, try these:

- Pay down credit card balances to reduce utilization.

- Avoid applying for multiple new credit cards.

- Set up automatic bill payments to avoid late fees.

- Deposit money into a savings account regularly (lenders may notice this).

Real-Life Example Scenario

Let’s say Alex has:

- Credit Score: 580

- Income: $3,500/month

- Debt Payments: $700/month (DTI = 20%)

- Down Payment: $6,000

Even with a poor credit score, Alex has:

- A reasonable DTI.

- A strong down payment.

- Proof of stable job.

A credit union could approve Alex for a $20,000 EV loan with a 12% interest rate. After one year of on-time payments, Alex refinances at 6.5%, saving thousands.

Conclusion: Driving Your EV Dream Is Possible

A low credit score doesn’t have to stop you from getting an EV loan. By checking your credit report, saving for a larger down payment, choosing the right lender, and considering options like co-signers or refinancing, you can improve your chances of approval.

Yes, you may face higher interest rates at first—but with smart planning and consistent payments, you’ll build your credit and soon qualify for better terms.

🚗💡 Bottom line: If you’re determined to drive an EV, even bad credit won’t hold you back—you just need the right strategy.

Leave a Reply